It’s not natural for me to cut my kid’s hair or the corners of juice boxes to save a couple of bucks here and there. I’d never last living a life like that.

Are you with me so far? If yes, keep reading…

Being smart with your money means you make changes that are doable and will last.

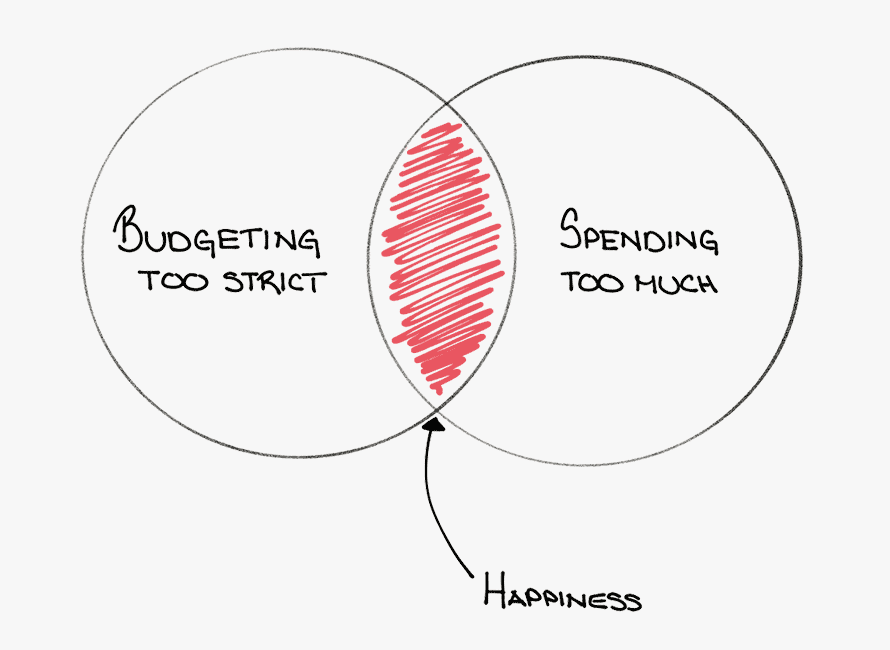

Let me show you what I mean. Check out this venn diagram:

Spending too much is a recipe for disaster

You need to spend money to live. Spending money in isn’t bad.

But If you make good money and have debt built up, then chances are you spend too much. And that’s not good.

I know it doesn’t feel that you’re blowing away all your money. But your debt keeps on getting bigger. What’s up with that? Probably because you don’t have a system around your money.

Simply put, you need a budget system, that tells you how much you can spend guilt free.

Budgeting too strict also a recipe for disaster

Pushing yourself to the financial limit might work in the short run. But it never lasts for long. Extremism always pushes back. Before you know it, you’ll be catapulted right back into spending and never want to budget again.

Also, going on a super-frugality mission is usually a bad marriage mission. Just because you’re all gung ho doesn’t mean your spouse is. Tightening the belt and feeling tight usually ends in unhappy marriages. It’s just not worth the trade off.

Being smart with money is the way to go

When it comes to finances, being smart means being normal with your money. You don’t need to be super stingy and save a million bucks. All you need is to be is normal so you’re comfortable.